Fintech Marketing Agency

Strategy-first digital marketing agency for fintechs.

Creative, data-driven solutions for growing scale-ups and global fintech leaders.

KYC360 case study: Delivering £3.2m pipeline growth with performance marketing

Morrinson Wealth case study: Content marketing and demand generation that delivered high-quality leads

Sopra Banking Software case study: Repositioning a mortgage platform for the UK market

Lenvi case study: Brand strategy and visual identity for a new breed B2B Fintech

Why partner with us?

Access the expertise you need

Direct access to digital marketing experts - not relationship managers. We’re not just an extension of your team, we’re fully integrated and able to scale resources up or down as your needs evolve

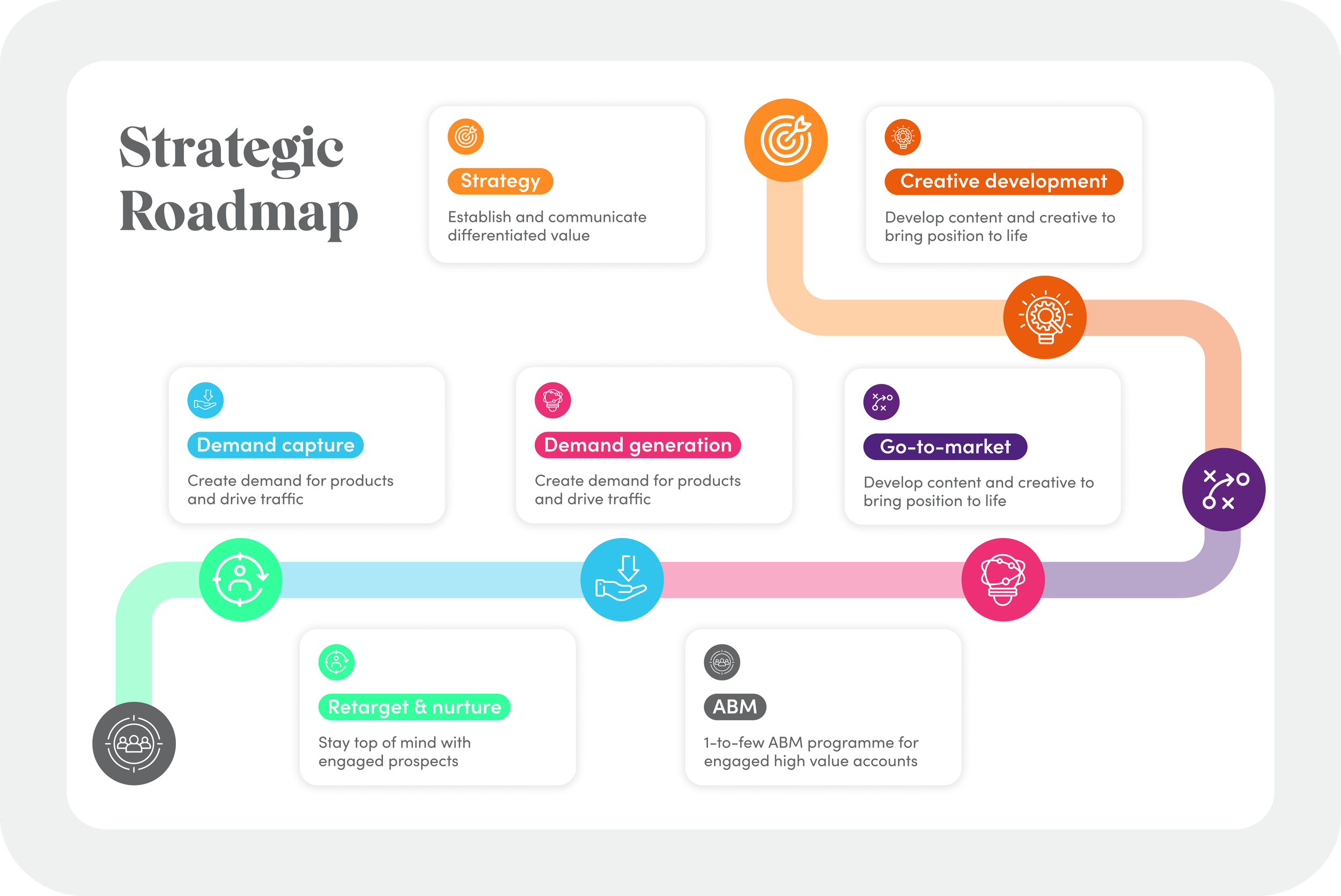

TAILORED StrategIC ROADMAP

We’ll gain a deep understanding of your business and products or services to define a marketing strategy aligned to your unique business goals

No learning curve

We know B2B fintech inside out. With 8 years of experience, tried-and-tested systems, and a deep grasp of regulated products and the audiences you want to attract

Solving Fintech marketing challenges

sound familiar?

Simplifying complex buyer journeys to reduce sales cycles

Engaging COOs, CTOs and Heads of Product

Developing a growth strategy whilst still delivering results

Creating a positive impression of marketing in the business

Fintech digital marketing agency services

Blockchain

•

Lending

•

Payments

•

Regtech

•

Alternative finance

•

Wealth tech

•

InsureTech

•

Blockchain • Lending • Payments • Regtech • Alternative finance • Wealth tech • InsureTech •

Fintech Marketing Process

01.

Marketing Discovery

Market Analysis

We’ll research your market, the drivers and shifts that could be impacting you and your audience.

Audience Definition

A deep dive into your ICP and personas, to understand their demographics and psychographics.

Competitors

Who are they, what are they saying and how are they marketing and positioning themselves.

02.

Marketing Strategy

Positioning

How can we uniquely position you versus the competition in the context of your audience’s pain points and goals.

Messaging

Create a messaging framework that aligns your products or services to the audience needs.

03.

Marketing Activation

Our fintech marketing process takes you from insight to impact — combining discovery, strategy, and activation into a streamlined approach that delivers measurable results.

Go-To-Market

A documented Go-To-Market strategy including all the key outputs from the discovery and strategy phases.

Activation Plan

A comprehensive marketing activation plan, created for each digital channel.

Roadmap

A marketing roadmap that charts your progress to achieve your goals and long term vision for marketing.

Richard Hoffman - Head of Marketing, Alto IRA

Curious Cat was an incredible partner to us as we rebuilt our Marketing function from the ground up. The job was a daunting one as we required support with analytics, strategy, SEO, and multi-channel paid media, but they never shied away from the work. I'd happily work with them again given the chance.

Serving all phases of Fintech growth

Start-up

Whether you need to build a brand, launch a website, or craft your first go-to-market strategy, we help fintech start-ups establish strong foundations. By outsourcing your marketing to a specialist fintech agency, you can stay lean, move fast, and focus on growth.

Scale-Up

You’ve built momentum and now need to accelerate. Whether you’re looking to plug specialist skill gaps or outsource your entire marketing function, our seasoned fintech experts bring fresh ideas and proven strategies to fuel your next stage of growth.

Enterprise

You have a strong marketing division, but resources are always stretched. Whether you’re launching a new product, running a major campaign, or looking to sharpen performance, we provide the extra resource and fintech expertise to deliver.

Foundations of fintech marketing

-

With the increase in Financial technology companies, it’s easy to get lost in the noise. Through a process of market research, competitor analysis, and audience discovery, defining your position will separate you from your competitors.

-

The buyer journey is complex, involving multiple touchpoints before a decision is made. Define a content strategy aligned to your buyer’s challenges and use a combination of channels including organic and paid channels to reach and support buyers through their journey.

-

Once you have defined your audience personas, you'll understand the challenges your buyers face and how your product uniquely solves them. Creating a consistent approach to messaging will give you a memorable voice in the market.

-

Only 5% of your buyers are in the market at any particular time. An always-on approach will ensure you engage and nurture 95% of buyers who aren’t yet ready to buy. When they come to market, you’ll be top of mind and ahead of the competition.

Fintech B2B Marketing Strategy

We help fintechs choose and execute the right growth strategy — whether that means creating broad market demand or winning high-value accounts

Demand Generation

Fintechs with a clear ideal customer profile use demand generation to build awareness at scale, earn trust in the market, and create consistent inbound demand. We design and run demand gen programs that expand your reach, showcase your expertise, and generate qualified interest in your brand.

Account-Based Marketing (ABM)

For fintechs selling into enterprise businesses, where long sales cycles and complex buying groups are the norm, ABM is essential. We help you identify high-value accounts, craft tailored messaging, and execute targeted campaigns that build relationships and accelerate deal velocity.

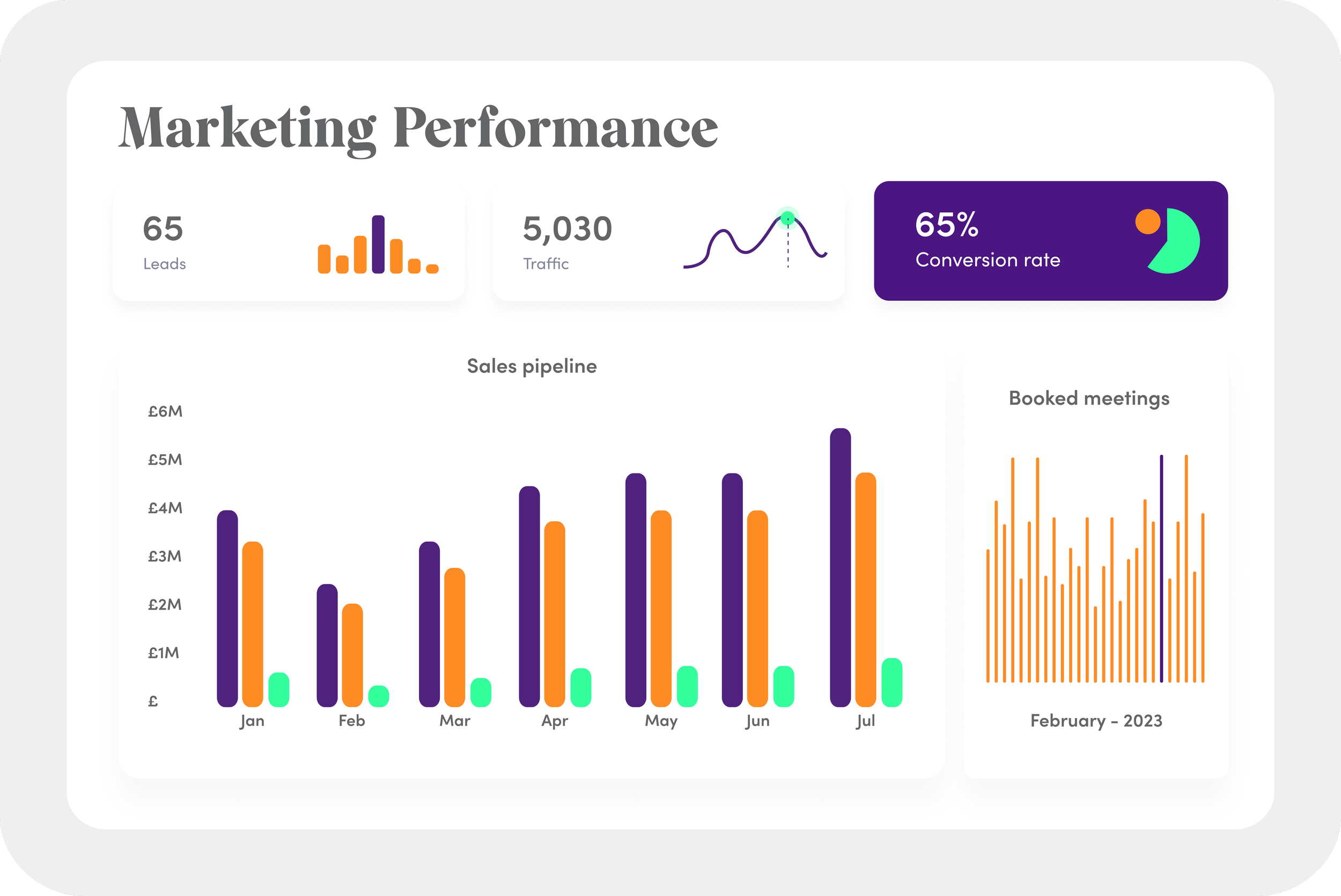

Your roadmap, your pace

We create a marketing roadmap built around your commercial goals, with clear milestones and transparent reporting, you’ll always know what’s happening and how it drives pipeline and revenue.

Our approach is flexible, collaborative, and grounded in deep fintech expertise. We adapt as your priorities evolve, scaling up what works and changing course where needed. You can choose for us to deliver and be accountable every step of the way, or take the roadmap in-house to run at your own pace.

Paul Whittingham - Co-Owner, Curious Cat Digital

Having spent 15 years working for B2B Fintechs, I became frustrated that agencies didn't have industry experience and therefore didn't speak the same language. We wanted access to Fintech experts, who understood our audience and could use those insights to drive our marketing strategy forward. That's why Curious Cat Digital exists.

Recognition

Marketing Agency of the Year 2024 - Finalist

Global Marketing Agency of the Year 2023 - Finalist

Fintech Marketing FAQs

-

Fintech marketing is the activity a fintech business undertakes to engage and attract its target audience with the goal of selling its products or services.

Fintech Marketing Strategy

Fintech marketing starts with strategy. The marketing strategy is focused on developing the fintech’s unique position in the market, which clearly aligns its products or services with the needs of its audience and differentiates the fintech from its competition.

-

Fintechs use a variety of strategies and channels to advertise their products or services. Advertising is a crucial element of marketing, allowing fintechs to promote their offerings and reach their target audience. Here are some common methods and approaches used by fintech marketing teams or agencies.

Traditional Advertising:

Whilst traditional advertising is used by fintech, it’s less common than digital advertising. Some examples of traditional advertising include:

Direct Mail: Promotional materials, such as flyers, catalogues, or postcards, directly to individuals' homes or businesses. With the proliferation of emails, this can be an effective way of standing out.

Print Media: Placing ads in newspapers, magazines, brochures, or other printed materials.

Television: Commercials are created and aired during TV programs. Specific time slots or channels can be targeted based on the fintech’s audience demographics.

Radio: Ads are broadcasted on radio stations, reaching listeners based on their demographics and listening habits.

Outdoor Advertising: Billboards, posters, signage, and other outdoor displays are used to capture attention in public spaces. You’ll see a lot of consumer Fintechs advertising in this way on the London underground.

Digital Advertising:

Digital advertising is more popular amongst fintechs as it aligns with their more tech-savvy target audience and is easier to measure than traditional advertising. It also provides instant data to the marketer to make quick decisions on what’s working.

Online Ads: There are a variety of different forms of digital ads, including display ads (banners, pop-ups), search engine ads (Google AdWords), paid social ads (Facebook, Instagram), and video ads (YouTube). The type of advertising is selected according to the goal the fintech is trying to achieve.

Influencer Marketing: Collaborating with social media influencers or bloggers who have a large following to promote their products or services is growing in popularity. If the fintech wants to appeal to a particular niche, micro-influencers can be a more cost-effective way of doing this.

Email Marketing: Still an immensely popular form of advertising, Fintechs use targeted promotional emails sent to subscribers, providing information, discounts, or special offers. As email marketing continues to grow, it's crucial to ensure that the content is not only relevant but also provides value.

Content Marketing: Creating valuable, relevant and entertaining content, such as blog posts, videos, or podcasts, is still extremely effective and can also support an SEO strategy.

-

Faster agency onboarding experience

Quicker time-to revenue, with less time spent testing and learning

Faster agency onboarding experience

Insights into which channels and tactics work best for your target audience

Access to an ecosystem of fintech specialists, to cater to call your requirements

-

If you want to scale your Fintech brand, you need to think long term and nail down a comprehensive strategy, creating commercial catnip for your customers. That means putting yourself in their shoes, thinking like they think.

But above all, you need to be curious. Always asking questions, challenging assumptions, and exploring new possibilities for your marketing. That’s how you always land on your feet.

And it turns out that’s exactly what we do.

Access the expertise your fintech needs to succeed

Schedule a no-obligation call to discuss how we can help solve your biggest marketing challenges and support business growth.